REal Estate Investing Summary:

Helpful Definitions

1.Preferred Return (Pref) Amount paid to investors before any cash flow is received by managers. Returns accrue annually ensuring investor priorities.

2.Equity Multiple Profit to Investment Ratio 2x would mean $100,000 invested returns $200,000.

3.Equity Split Proportional split of all monetization - derived from equity contribution as a percentage of total capital raised.

4.Internal Rate of Return (IRR) Measured return on investment based on amount

Core Services:

Under Writing: Our meticulous underwriting process involves thorough market analysis, property valuation, and risk assessment to identify lucrative investment opportunities with strong potential for growth and profitability.

Property Management: Day-to-day management includes diligent maintenance, prompt issue resolution, and proactive tenant communication, ensuring optimal property performance and tenant satisfaction.

We take the hastle out of Real Estate Investing

We meticulously analyze various indicators, including population growth, inbound migration, growth over the last 10 years in population, growth over the last 5 years in GDP, property taxes, landlord vs. tenant friendliness, business migration, geographic trends, to inform our selection process

Macro Considerations: Indicators such as population growth, inbound migration, economic performance, property taxes, landlord-tenant dynamics, business migration, geographic trends

Micro Considerations:Commute times, cost of living, crime rates, employment, and overall desirability and potential of each location

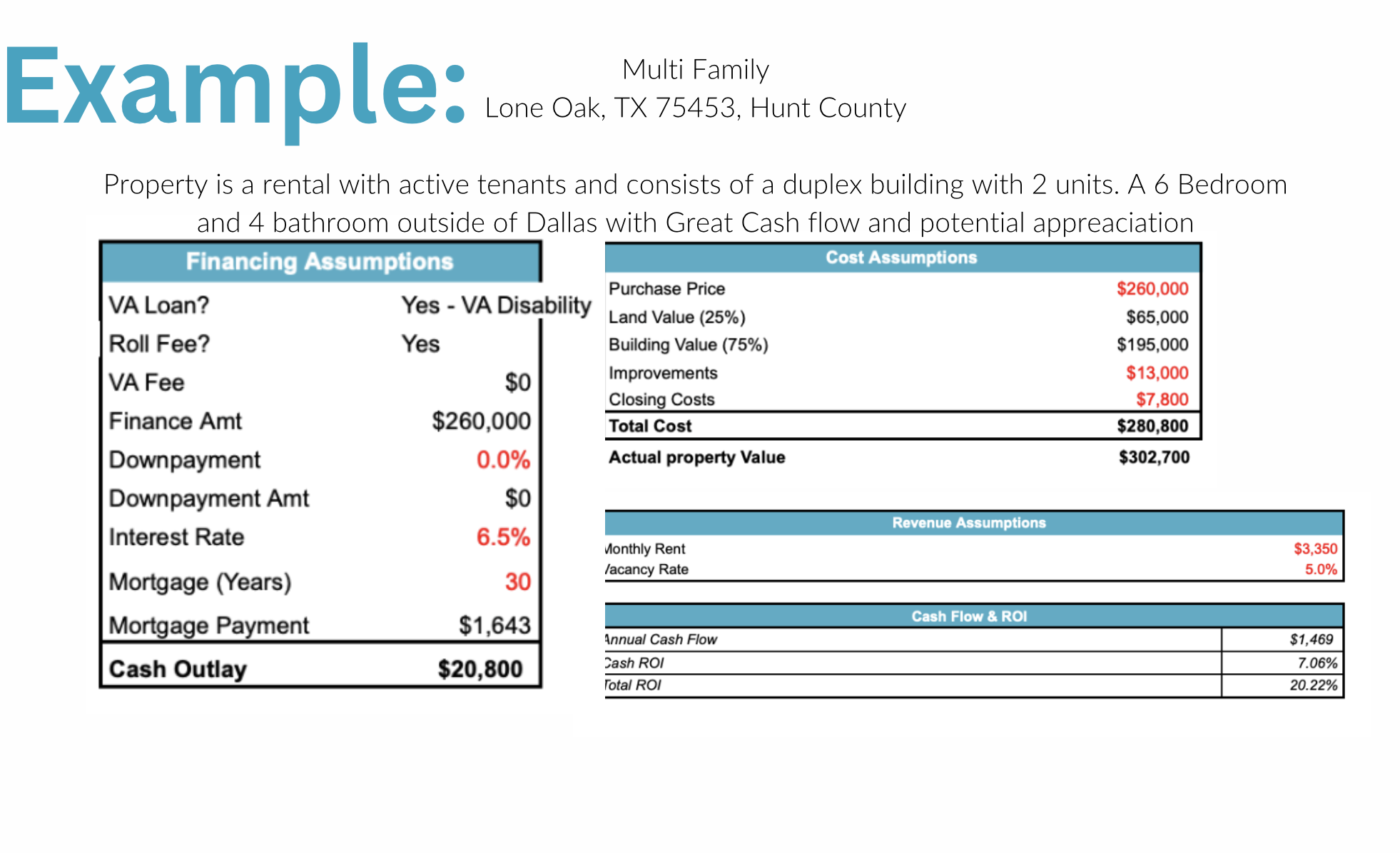

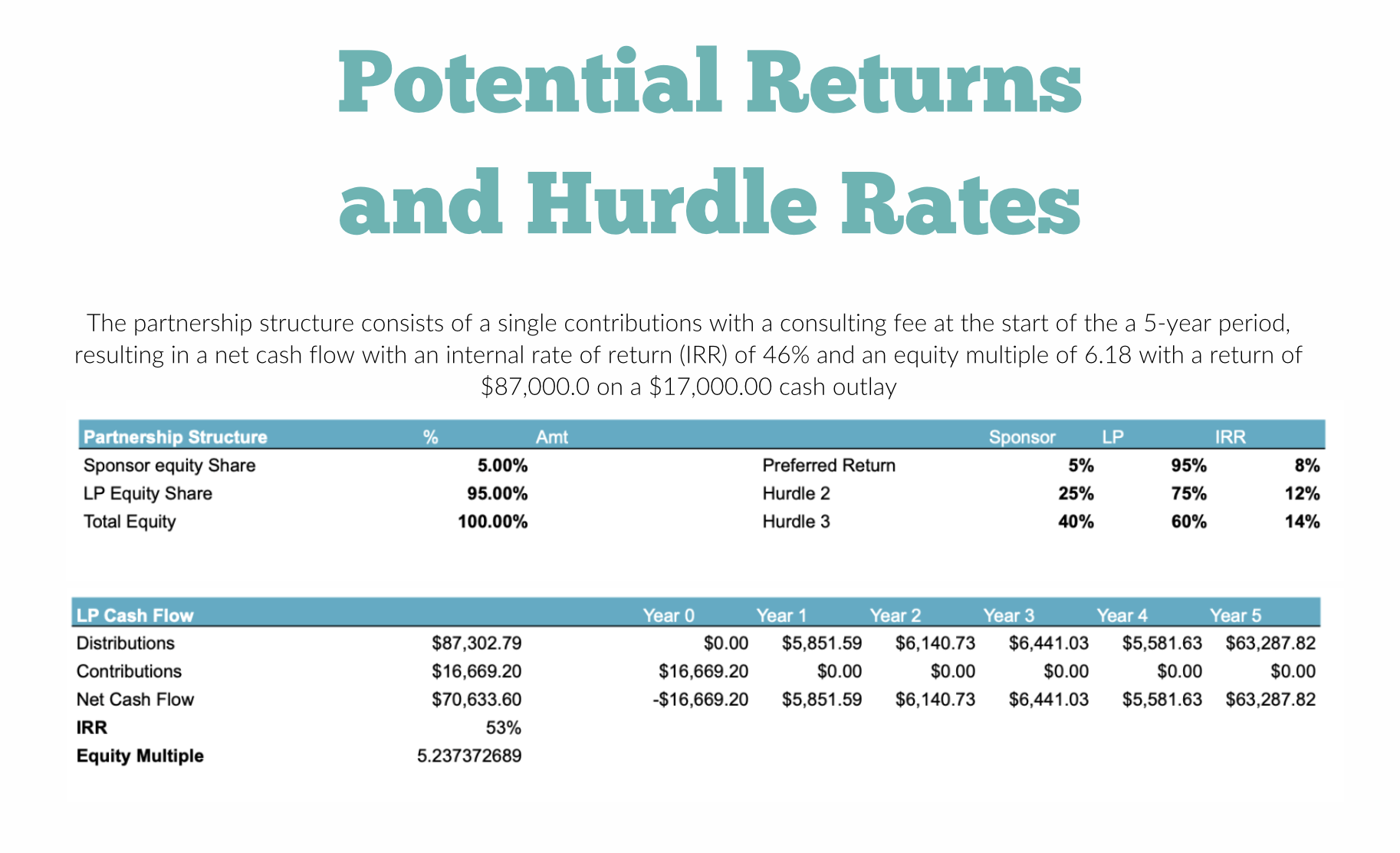

Introducing an exceptional investment type opportunity This example property located at 306 & 308 Mill St, this property is a lucrative 6-bedroom, 4-bath duplex priced between $200,000.00 to $260,000.00 for acquisition. Currently generating $3,350.00 in monthly cash flow, this rental property comes with active tenants and promising potential for appreciation. With a strategic repair plan including new floors, cabinet doors, appliances, and more, this investment offers a robust return on investment. Partner with us for a single contribution and consulting fee, yielding a compelling net cash flow, an impressive internal rate of return (IRR) of 46%, and an equity multiple of 6.18 over a 5-year period, ensuring a return of $87,000.00 on a minimal cash outlay of $17,000.00. Don't miss out on these opportunities to secure your future in real estate investment.